Disclosure of Sustainability Information

ESG

Magallanes has been a signatory to the United Nations PRI for several years. We believe companies, in the development of their activity, have positive and negative impacts on society and the environment that must be managed. Their duty is to try to enhance the positives ones and reduce the negatives ones. Not considering environmental, social, and corporate governance factors could have impact on a company’s profitability as well as its share price.

When analyzing a company, within the normal activity of the investment process, in addition to purely economic and financial factors, we also take into account its environmental, social and governance policies. Specifically, those aspects related to reputation, good governance, integrity and commitment to the environment and the economic agents that comprise it. Such policies must be observable, realistic and measurable, on top of showing a clear positive evolution and a constant vocation for improvement in all metrics.

For example, companies with policies to reduce their negative impacts on the environment will be more sustainable as they will have lower potential risks of sanctions, fines, production stoppages, etc. Similarly, those that try to improve their social impact will have less turnover among their employees, resulting in a better perception by their customers and suppliers. In the same way that a good business model can be ruined by bad corporate governance.

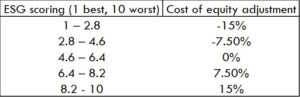

ESG criteria are incorporated into the standard analysis and valuation process carried out within the Magallanes’ investment process through an internal ESG scoring system that translates into a valuation adjustment. This is done by increasing the cost of capital of those companies with the lowest score and reducing the one of those with the highest score

Such adjustmemt will positively or negatively impact the upside potential of the company in question. Thus, those companies developing excellent ESG policies and showing a better performance versus peers are rewarded, and those who are more deficient are punished.

The concept of good ESG practices refers to the promotion, support and interaction with all agents involved in the interest of a better world where to live and work, with special emphasis on all those businesses promoting the society’s social and economic progress. Among these can be from renewable energies to steel producers, through car manufacturers or financial service providers, all all of them valid as long as they contribute to said progress with clear and firm ESG policies and an intention of constant improvement.

Sometimes, however, we understand that there are certain activities that contribute nothing to the progress of society, rather the opposite. In such cases we do consider the exclusion as an appropriate tool in accordance with good ESG practices. For example, pornography, anti-personnel landmines or gambling houses, would be among these activities.

Integration of sustainability risks

The investment process takes into account sustainability risks and is based on internal analysis, punctually supported by third-party analysis. For this, the Fund Manager uses its own methodology based on combining information obtained or published by the companies in which it invests and external ESG analysis providers’ scores, resulting in an internal and aggregated ESG scoring which will then translated into an adjustment in valuation in the investment process.

Statement regarding the principal adverse impacts of investment decisions on sustainability factors

Magallanes does not take into account the Principal Adverse Impacts (PAIs) of investment decisions on sustainability factors as it does not currently have PIAs due diligence policies at the Entity level.

Our analysts are nevertheless monitoring the PAIs reported by third party providers for portfolio companies. The level of coverage is, in many cases, very limited and with a high level of estimation, which means that the processing of the data for this purpose is, for the time being, insufficient to be able to clearly disseminate the data to our investors in order to fulfill the intended purpose and provide a minimum comparability that can be taken into account in their investment decisions.

Not being mandatory, according to Regulations (EU) 2019/2088 and (EU) 2022/1288, we understand that, until the full effectiveness of the legislative measures initiated with the reform of several provisions by Directive (EU) 2022/2464, we will continue to find estimated data, insufficient coverage, lack of a consolidated and reliable public registry of indicators of Principal Adverse Incidents, all circumstances that we consider necessary to reflect a real and true image to the investor on this matter. These shortcomings are accentuated by our management style – value investing – where we sometimes find value in companies that go unnoticed by the consensus, analysts and the market.

All this, together with the size of our company, means that for the moment we have not been able to take a decision in accordance with the clarity we demand in the information we provide to our investors.

We are confident that this situation will improve as the companies in our investment universe and/or suppliers settle the data to be reported in an efficient manner, at which time Magallanes will be able to execute and put into practice due diligence policies on PIAS at the Entity level that will generate uniform and coherent information for our investors that will justify allocating a larger budget than the one currently approved in this area, a fact that we do not estimate will occur before 2026.

Funds promoting ESG characteristics

Our funds promote environmental or social characteristics, without having an explicit sustainable objective. As a result of the investment process itself, the product may partially invest in sustainable investments, understood as those investments in economic activities which contribute to an environmental or social objective and do not significantly damage any environmental or social objective, provided that the companies invested in follow good governance practices with ESG characteristics.

- Magallanes Value Investors, UCITs – European Equity

- Magallanes Value Investos, UCITs – Iberian Equity

Characteristics promoted, social and environmental indicators

Environmental characteristics promoted by this financial product are: adaptation to climate change, pollution prevention and control, as well as sustainable use and protection of resources, with greenhouse gases emission, responsible water consumption, R&D investment and environmental litigation being the key Environmental Indicators. As for social characteristics, reduction of reputational risk, prevention of workplace accidents, human talent attraction and retention are promoted, by following the following Social Indicators: equality and diversity, controversy ratios, employees’ physical security, number of accidents and deaths, training and qualification, employee rotation and corporate social responsibility (CSR) policies.

Methodology: evaluation, measurement, control, impact and sources

The following sectors are excluded: adult entertainment/pornography, weapons of mass destruction, anti-personnel landmines, gambling, casinos, and specifically sectors related to Chinese military companies included as “Sanctioned Companies” under order 13959 of November 12, 2020, updated on January 13, 2021. Complementary to this, we could also exclude investment in companies, in a “company-by-company” approach, if they showed a deterioration in their ESG ratings and policies.

The Fund Manager uses its own evaluation methodology based on information obtained or published by the companies in which it invests, punctually supported by external ESG analysis suppliers. The result is an internal and aggregated ESG scoring which will then be translated into an adjustment in valuation in the investment process, increasing or reducing (penalizing/ rewarding) the cost of capital of those companies with the worst/best ESG score, as shown in the following table:

The inclusion of companies in specific indices in ESG matters (e.g. FTSE4Good Index Series) will automatically enable the company’s consideration as “according to ESG criteria”. The fact that these organizations have many specialized resources in these matters makes the mere inclusion in one of their indexes serve as a guarantee of compliance.

Our level of engagement with companies is highest. In this sense, there is a continuous and active monitorization and control of ESG criteria, through the monitoring, studying and periodic analysis of documents such as Annual Reports and Non-Financial Statements. On top of this, regular meetings are held with the companies, where, in addition to economic, financial and strategic factors, ESG issues are addressed to analyze their level of commitment and vocation for improvement, as well as the measures taken in order to achieve the environmental and social objectives promoted by the product.

Impact fund

The hedge fund invests in the debt of Microfinance Entities in developing countries whose activity is to finance, through microcredits, projects of the most disadvantaged people and communities, with no access to traditional banking services. In such way, the hedge fund FIL contributes to fighting inequality, strengthening social cohesion and integration and the women’s role in these communities.

Social characteristics of the hedge fund’s sustainable investment objective

The hedge fund invests in the debt of Microfinance Entities in developing countries whose activity is to finance, through microcredits, projects of the most disadvantaged people and communities, with no access to traditional banking services. In such way, the hedge fund FIL contributes to fighting inequality, strengthening social cohesion and integration and the women’s role in these communities.

Methodology: evaluation, measurement, control, impact and sources

Given that the hedge fund’s commitment is for investments to have a relevant social impact, its performance is linked to such an evaluation. To this end, the Fund Manager, in collaboration with Gawa Capital Partners SGEIC SA as the hedge fund’s investment advisor, measures the portfolio’ s social impact, calculating an annual Social Impact score (with a range from 0 to 1). The hedge fund’s aim is to maximize such annual score, considering that scoring below or equal to 0.30 is a poor score, unaligned from its purpose. The score is an equal-weighted average of a scale of 25 essential aspects assigned to the loan issuers (24 of which are a subgroup of the 150 ALINUS scores, plus a last one relative to the issuer’s size) grouped by areas (entity’s mission and governance, client protection principles, product and services range, client mix: women, unbanked customers, clients in rural areas, etc.) as well as social responsibility in relation to employees and the environment. In the first half of the year, the Fund Manager will calculate the previous year’s score. Should it be below or equal to 0.30, the management fee will be returned to the hedge fund before September 30. It must be taken into account that the score calculated by the Fund Manager may differ from the one calculated by ALINUS, as the Fund manager is only using part of the ALINUS 150 variables. In consequence, the management fee may be charged in certain cases in which it would have been returned had all of the 150 ALINUS variables been applied.

- Magallanes Impacto, FIL